Happy Friday, Daily Direction readers!

Gold futures (GC) are about to hit our price limit! That means we should expect a sell-off once the market hits 1871.6. While we’re still actively buying the market, we’ll take a step back once the limit is reached.

We’re oh so close to that limit, meaning the short-term direction is about to turn down. But the long-term direction remains up, so we’ll wait for the next bullish push after the upcoming sell-off.

I expect the market to dip back toward the bottom of the channel before giving us a U-turn and a push back into the buy zone.

Our best bet is to carefully watch our timeframe charts and follow the GC as it makes its next shift in the short term.

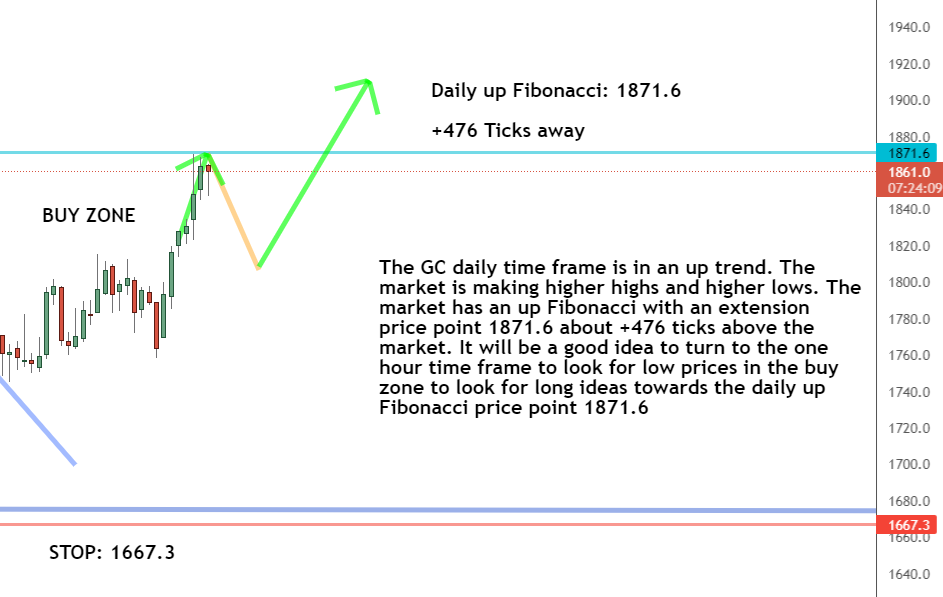

Daily Timeframe Analysis

The long-term direction for the GC remains up, as evidenced by the channel in our daily timeframe chart. That means the market continues to march its way to a new high price, despite a wave of ups and downs along the way.

And we can see how close the GC is to our price limit of 1871.6. Expect the market to begin a downward push once we hit that price point. The sell-off will be temporary, so don’t worry!DAILY TIMEFRAME

The long-term direction is up for the GC

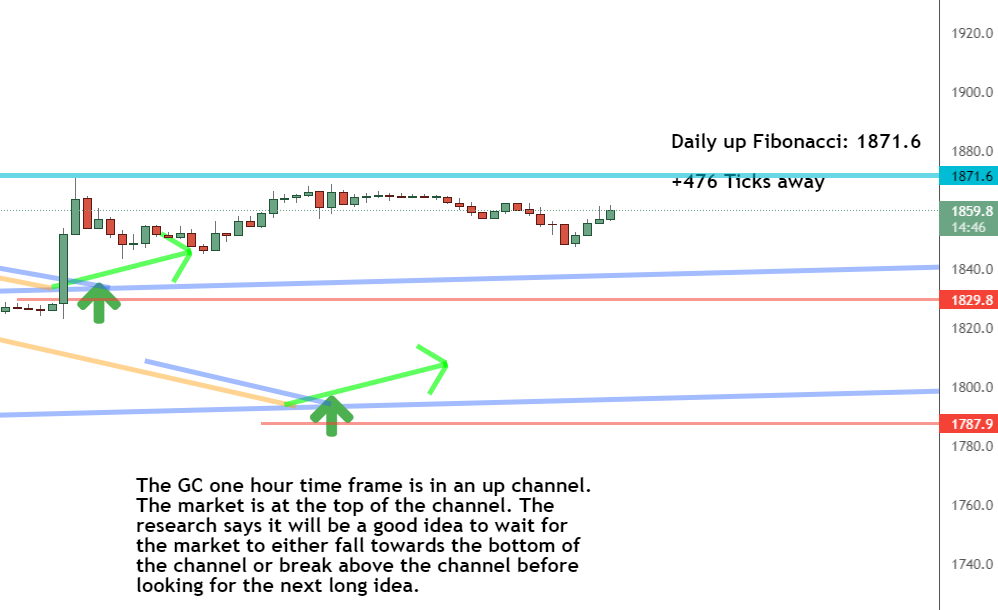

1-HR TIMEFRAME

The short-term direction of the GC is up, but could be shifting downward soon

THE BOTTOM LINE

The GC is headed for a sell off once it hits our price limit

Learn more about the Daily Direction Indicators here…

Once the sell-off hits, we’ll keep an eye on our daily timeframe to see when the trend reverses back toward a positive push.

As soon as that happens, we’ll turn to the one-hour timeframe and start looking for opportunities to get back into the GC.

One-Hour Timeframe Analysis

The one-hour timeframe shows how sideways the GC market has traded recently. But the short-term direction for the market remains up despite the constant ups and downs within this timeframe.

But a closer look reveals that we aren’t too far away from our price limit. It’s the short-term direction that will see a direction change once we hit that price point.

Expect a retracement (temporary price drop) followed by a new bullish rally. Remember, the long-term direction is up, so that means the sell-off in the short-term will reverse and give us a nice low price to buy the GC on the way back up!

The Bottom Line

As the GC approaches our price limit of 1871.6, we’ll expect a pullback toward the bottom of the channel. Unfortunately, that means we’ll see a sell-off from the current price. But the overall direction remains up for the GC, so we aren’t done with this market.

Once the retracement settles down, we’ll look for a reversal back toward a bullish push and prepare our entry strategy to buy the GC again on it’s way back into the buy zone.

The present GC setup demonstrates how my technique can assist you in navigating the ups and downs of the futures market. So, don’t wait any longer. Get started today! You don’t want to miss out on this.

Keep On Trading,

Mindset Advantage: Find Your Word

Make it up if you have to.

Do you have a breathing regime when trading? No joke, do you do your daily breathing exercises – especially during trades? Do you have a word that calms you down?

If your answer is ‘no’ then you should. We’ll loan you ours. Foooooo-shaaaaa-baaaaa. Every swear word you love, woven into one fantastic word. Say while breathing in ‘Foooooo’ and then while breathing out ‘shaaaabaaaaah’.

It will calm you down and bring focus. All together now…..

FooooooShaaaaaBaaaah…

Traders Training Session

Stay tuned for my next edition of Josh’s Daily Direction.

And if you know someone who’d love to make this a part of their morning routine, send them over to https://joshsdailydirection.com/ to get signed up!

The post We’re Close to Hitting Our Limit on This One appeared first on Josh Daily Direction.