Good Thursday morning, Daily Direction readers!

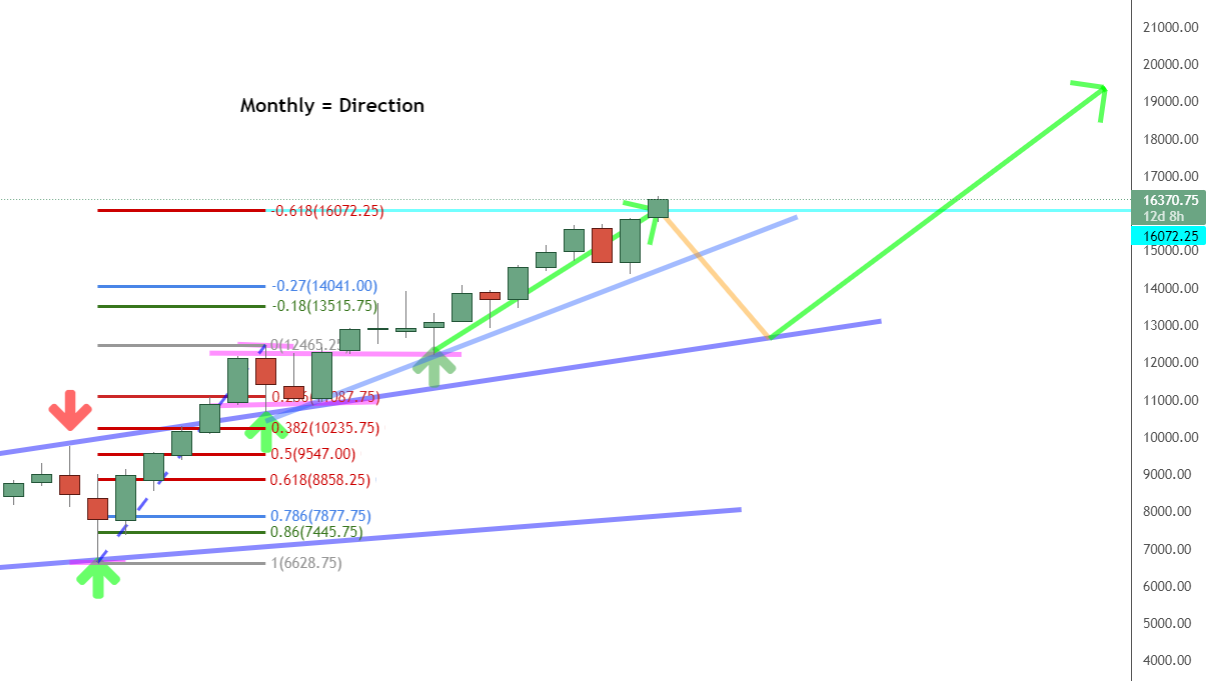

Today we’re looking at the Nasdaq 100 E-mini futures market (NQ). Right now, we’re currently out of the market. The NQ hit our price limit of 16072.25, meaning the current short-term direction is down as we wait for a lower price.

But we won’t step away from the NQ for too long. The long-term direction for the market remains up. That means the price drop we’re expecting is temporary.

Once we see the sell-off reverse, we’ll be in a position to buy the NQ at a low price as it rallies back toward the top of the channel.

It can be frustrating to wait for a market to get into a position for buying, but patience pays off. We want to manage our risk so that we have a better chance at making a profitable trade!

Let’s turn to the timeframe analysis to see the details behind the NQ’s current position:

Daily Timeframe Analysis

A quick look at the NQ’s daily timeframe charts shows the market zooming past our upper price limit, putting us out of the market for now.

It’s hard to believe for new traders, but a market price can be too high to buy. If we try and jump into the market now, we risk losing our money if/when the market decides to sell-off.

DAILY TIMEFRAME

The long-term direction is up for the NQ

1-HR TIMEFRAME

The short-term direction of the NQ is down

THE BOTTOM LINE

We’re waiting for the NQ to hit a low price and U-turn back bullish

Learn more about the Daily Direction Indicators here…

Remember that there are other traders out there looking to cash in their profits once the market hits resistance!

When that happens, the price drops. If we get in before that happens, we stand to lose a lot of money. Instead, we’ll wait for the market to drop toward the bottom of the channel. That’s when we’ll look for an opportunity to buy the NQ.

The Bottom Line

We’ve hit our limit in the NQ. We’re currently out of the market until we see a lower price toward the bottom of the channel and signs that the market is pushing bullish again.

As soon as the market gives us a low price and a counter trendline break, we’ll work on executing our buy-in strategy.

And don’t forget that the long-term direction is up, so we’ll get our chance to buy the NQ soon enough. For now, we’ll patiently wait.

Waiting can be tough. But it’s an important part of risk management. That’s why following my strategy can help you learn better trading habits. And those habits will help you become the trader you want to become!

Keep On Trading,

Mindset Advantage: Balance

When it comes to your mindset for trading, you’ll find that your ability to cope with the markets, bad trades, good trades – whatever – has more to do with how you spend your time outside of trading. More specifically, how much balance you have.

In fact, of your total state of readiness 10% may have to do with charts and price levels. The other 90% has to do with how rested you are. How focused you are. How happy you are.

Find a balance that works for you and begin the path towards happy trading.

Traders Training Session

Stay tuned for my next edition of Josh’s Daily Direction.

And if you know someone who’d love to make this a part of their morning routine, send them over to https://joshsdailydirection.com/ to get signed up!

The post What to Do With the NQ Right Now appeared first on Josh Daily Direction.