Hey, Ross here:

The market has continued to bounce – just as I said…

But what comes out of Powell’s big mouth later today will be key in determining where this bounce will be sustainable or not.

In the meantime, check out an interesting chart that shows what’s going on “beneath the surface” of the market.

Chart of the Day

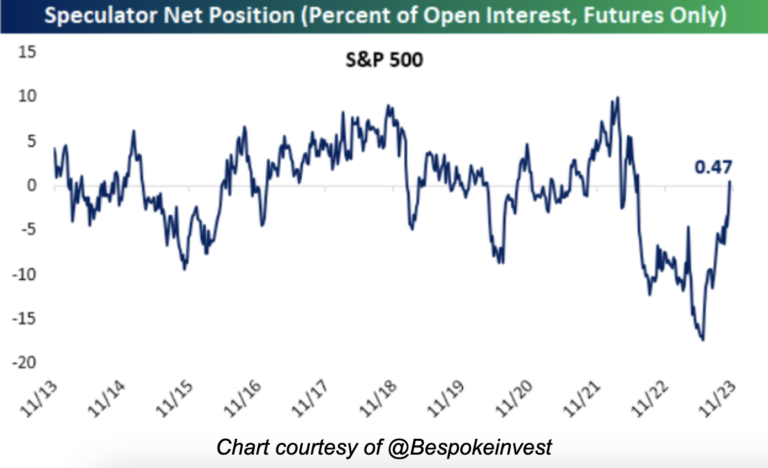

This chart shows the net options position on S&P 500 futures.

Anything above zero means there are more long positions than shorts – and anything below zero means there are more short positions than longs.

While the net options position on S&P 500 futures has been net short all year, the magnitude of this position has fluctuated wildly.

Starting in July the net short reading was the lowest in over a decade…

But as of last week, we are now back in a net long position – the first time since June 2022.

What does this mean?

Read the Insight of the Day to find out.

Insight of the Day

You can’t tell what’s REALLY going on in the market if all you rely upon is news and “gut feel”.

On the surface, the market mood still seems highly pessimistic.

But as I just showed you, beneath the surface, many traders have already quietly positioned themselves for a rally…

A rally that I said would happen.

If Powell doesn’t screw it up later, I believe this rally will continue – and present many quick-hit opportunities we can take advantage of.

It really depends on the Fed.

Powell’s press conference starts at 230 p.m. Eastern today…

Which is why at 4 p.m. Eastern today…

I’m going LIVE to go over the market landscape…

Break down the opportunities I’m seeing right now…

And show you my highest-percentage strategies for profiting from these opportunities.

So make sure you click here to save your seat for my live session later…

And I’ll see you at 4 p.m. ET sharp.

Embrace the surge,

Ross Givens

Editor, Stock Surge Daily