Good morning, Traders!

I recently picked the E-Mini Russell 2000 (RTY) as a buy, even though my gut wanted the market to drop to a lower price. Well, it turns out that my strategy won out over my emotions as the decision to go with the RTY paid off!

The bottom line of trading futures is buying at a low price and selling at the highest price possible before the market drops again. That’s why I sometimes hope that a particular market will drop if I know that the overall direction for the price is positive.

Remember that the market trades in waves. We’ll see ups and downs within an overall upward trend. We buy at the low points and sell at the highs.

While the rules of my strategy said that it’s time to buy the RTY, my gut said to wait for the price to drop. Since I’m a stickler for rules, I followed my strategy and called the RTY a buy.

And it’s a good thing I did because we’re currently seeing the RTY moving up toward the top of the channel! That’s how well my trading system works. Even when my emotions try to get in the way, it keeps me grounded and focused on the fundamentals of trading futures.

And you can leverage my system to help you make better trading decisions in the futures market. It’s as simple as following along with me as I trade. Here’s how to get started!

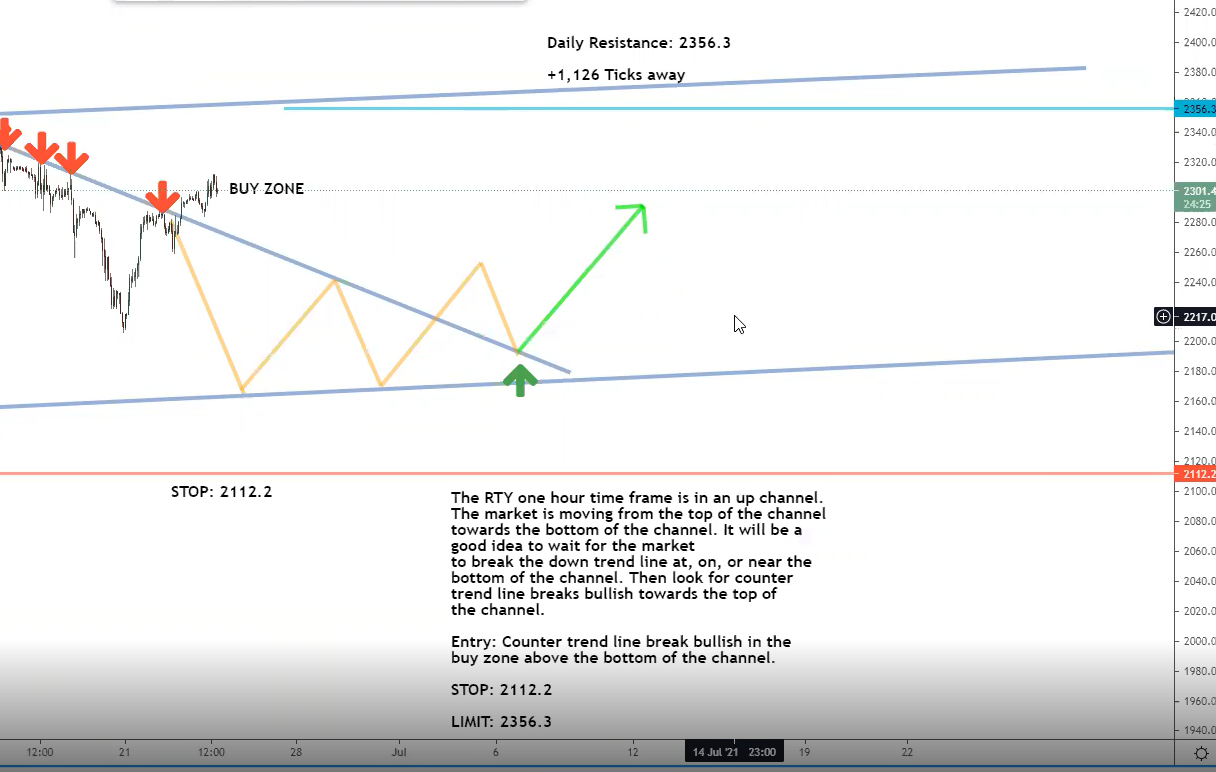

Now let’s examine the daily and one-hour timeframes for the RTY to understand the current setup:Daily Timeframe Analysis

The RTY daily timeframe is continuing its upward movement as it gets closer to resistance. Remember that resistance is the price point at which buyers start to slow down, and sellers gain control of the market. That’s typically when the price begins to drop.DAILY TIMEFRAME

The daily timeframe shows that the RTY has moved into the buy zone

The RTY one-hour timeframe confirms an overall up direction

The RTY has U-turned off support and is getting closer to resistance

Learn more about the Daily Direction Indicators here…

The RTY has pushed into the buy zone according to the daily timeframe. We’ll see the price continue to make positive gains on its way to the top of the channel (top grey line)

But that’s not always the case. Our current daily resistance level is 2356.3, but our up Fibonacci extension is 2588.1. Sometimes a market pushes past resistance, turning the backside of resistance into a new level of support. We could see that happen with the RTY.

Now’s a good time to review my article on predicting future price direction. It has the insight you need to trade setups just like this one. You can read it here and easily incorporate the information into your own trading strategy.

| Recommended Link:We can’t believe why almost no one is talking about this. It’s potentially the BIGGEST investment news of the decade. Today, we’ll show you how accessing a little-known portal in your brokerage account… Is the key to potentially amassing a quick fortune. You can start with a minimum average investment of just $500… And turn it into a mind-blowing $50,000 payout! All because the Chicago Mercantile Exchange (known as the “Merc”), the giant 171-year old trading marketplace, effectively turned the investing world on its head. Overnight, they created a lucrative loophole so big it lets thousands of ordinary, hard-working Americans earn huge sums of extra cash. |

One-Hour Timeframe Analysis

The RTY one-hour timeframe broke into the buy zone, just as my trade setup predicted. While I would have liked to see the price of the RTY drop before the next rally, rules are rules. Even I can’t argue with how well my strategy works!

The RTY one-hour timeframe confirms that the market is in the buy zone. The price will move in waves as it heads towards resistance (upper light blue line)

As you can see in the chart, the market clearly broke through the trendline (downward running grey line) and entered the buy zone. That means the price is headed in the right direction as it moves toward the top of the channel (upper grey line).

I know that all this talk about trendlines can be confusing, so take the time to study up on how they work and the proper way to draw them. You absolutely cannot trade with my strategy without knowing how to utilize trend lines. Read my informational article here to learn today.The Bottom Line

The RTY is trading profitably right now, and my system called it even when I wanted the market to go in a different direction.

My strategy prevented me from allowing my emotions to get in the way of a profitable trade. That’s the number one reason why traders end up losing money. You can’t let your feelings cloud your judgment. But it’s near impossible to do that if you don’t have the right tools and strategy to help you make the right calls at the right time.

My strategy accurately predicted the current RTY movement, despite my wishes that the price would drop!

So what’s your excuse for not working toward fulfilling your financial goals? There’s no reason why you shouldn’t get started today. Even if you have questions, I have the resources to help you find the answers. Bottom line: today is the day to start building your trading empire!

Keep On Trading,

Mindset Advantage: Accept

It’s not the market. It’s not your indicator. It’s TRADING.

Let it go. The first step toward consistent profits comes when you accept the reality that losses will occur.

Prices have a mind of their own at times. The institutions are at the wheel. The sooner you accept this, the more progress you’ll make.

Look at the past, but don’t stare. Accept what’s happened and move on.

Target tighter entries. Get the heck out of those losers you’re hanging on to.

Accept. And start to enjoy trading.Traders Training Session

Don’t let sloppy stop orders ruin your trade!

2 Comments

June 26, 2021 @ 10:42 pm

That super cool, really interested in joining, however currently have all capital tied up in credit spreads, butterfly’s and condors waiting to capitalize toward expiration.

So, just curious what is the fee to join your prestigious organization, to plan for the future given the opportunity is presented?

Thank you,

July 20, 2021 @ 10:24 pm

Hi Rob! Thank so much for taking interest in the research we have to share with our students. When you’re ready, please feel free to give our highly trained customer service staff a call to discuss which of our research services best fits your needs and objectives. We look forward to working with you!