Happy Tuesday, Daily Direction readers!

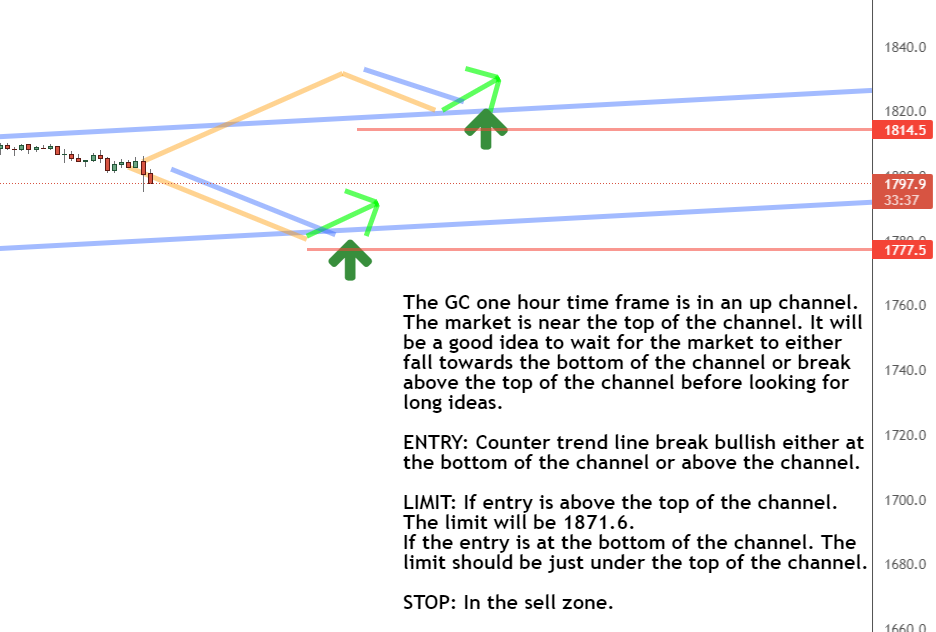

Today we’re waiting for gold futures (GC) to give us a new entry, as we’ve hit our limits in the market. The long-term direction remains up for the GC, but the short-term direction is now considered down, meaning we’re following our timeframe charts and waiting for the market to get back into a position for opportunities to buy the GC.

The daily timeframe is still moving upward, meaning the market is in a position to give us opportunities to trade in the long run. Within the one-hour timeframe, the GC has reached our latest price limit, meaning it’s too high to buy.

The market will either move to the bottom of the channel or break through the top and give us a counter trendline break. When either happens, we’ll keep looking for chances to buy the GC at low prices as it makes its way back into the buy zone at a low price.

Daily Timeframe Analysis

The market within the daily timeframe is still moving upward, meaning our long-term direction is still positive.

So long as the market continues on its upward trend, we’ll watch the one-hour timeframe and wait for new entries into the market.

The long-term direction is up for the GC

The short-term direction of the GC is down

We’re waiting for the GC to give us new entries in the short-term

Learn more about the Daily Direction Indicators here…

Within the daily timeframe, the GC continues on a positive path

Keep in mind that we use trendlines to determine when we should initiate a trade in various markets. We wouldn’t be able to make such forecasts without the data provided by the trendlines. That’s why drawing trendlines accurately is so important.

One-Hour Timeframe Analysis

Turning to the one-hour timeframe, we’re currently out of the GC as the market hit our limit. That means the price is too high to buy right now.

But remember that the long-term direction for the market is still up, so that means we won’t be out forever. At some point, the market will make one of two moves. Either one will allow us to rebuy the market.

The market could fall down toward the bottom of the channel before giving us a nice turnaround, or it could push through the top and then give us a counter trendline break back into a solid buy zone.

The GC broke the counter trendline and is rocketing toward our next point of resistance!

And if you’re trying to figure out what strategy to use for futures trading, be sure to check out what I have to offer. It’s the only way to take what I provide in the Daily Direction and apply it to real-world trading!

The Bottom Line

We’re currently out of the GC as the short-term direction for the market is now down. But that’s just a temporary position, as the long-term direction for the GC remains up.

That means the market will eventually give us new opportunities to buy it. Once that happens, we’ll have our timeframe charts to show us how and when to jump back into gold futures!

We’re out of the GC until the market gives us new entry points into the market

If you’re currently trading using one of my systems, you can now apply what you’ve learned to the GC market. If you haven’t already, now is the moment to get in and start working toward more profitable trades. There’s no reason why you can’t get started now!

One last thing: you need to check out this strategy that has the potential to put an extra $400 to $1000 a day in your account. I know it sounds impossible, but it all makes sense once you understand it! Here’s how to find out more.

Keep On Trading,

Mindset Advantage: Don’t Lose Focus

Minimize those screens. Stop texting. Stop Stressing.

Everyone talks about it. Very few people do it. Why? Because it’s darn near impossible!

To find true focus in this day and age is nearly unheard of. No wonder meditation camps are springing up all over the world.

Instead of taking 8 hours to ponder the many edges and textures of a raisin… why not just shut off a few distractions?

Turn off the extra screens. Put the flat screen with the news on mute.

Stop texting. Just you and the market. Start seeing it at its natural pace – not as it comes to you (because you’re catching up).

Find focus and see the opportunities!

Traders Training Session

Anticipating Future Market Price Direction

Stay tuned for my next edition of Josh’s Daily Direction.

And if you know someone who’d love to make this a part of their morning routine, send them over to https://joshsdailydirection.

The post Why Long and Short Term Directions Matter appeared first on Josh Daily Direction.