Like the broad stock market, digital currency futures tumbled sharply on Thursday morning following the hotter-than-expected consumer price index (CPI) reading.

BTC futures were down by over 6% early in the session before turning around and closing mildly in the green.

On the surface, this looks like a false breakdown that could turn the market to the upside in the short term.

However, when you zoom out to look at the big picture, it’s clear that the selling is likely not over yet for BTC futures…

BTC Still Set to Break Down

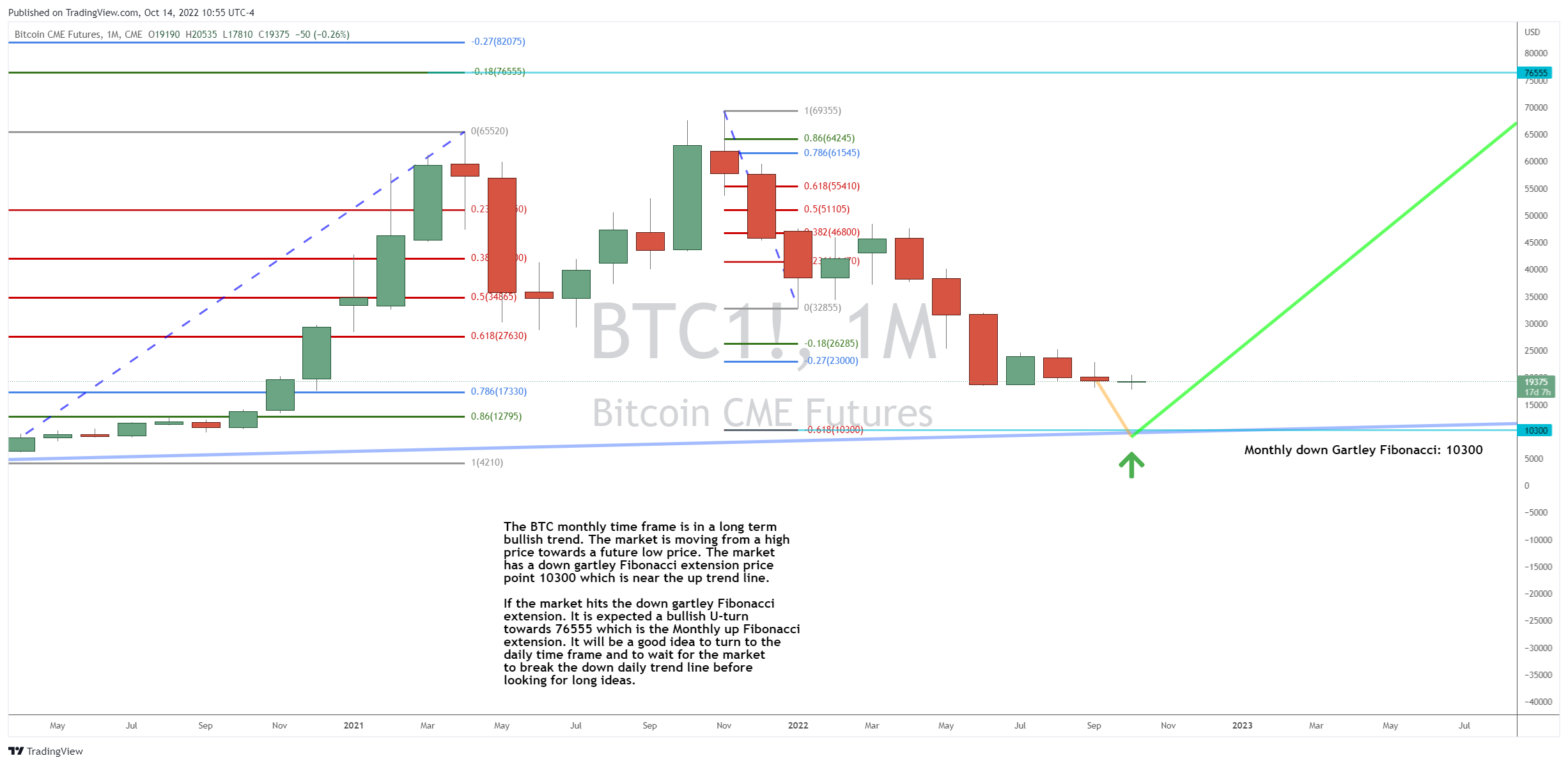

On the monthly time frame, BTC is in a long term bullish trend.

However, the market is moving from a high price towards a future low price and has not yet reached the down Gartley Fibonacci extension price at 10,300 near the long term up trend line.

And on the daily time frame, BTC is still locked in a down trend, with the market making lower lows and lower highs.

There is a down Fibonacci extension below the market price point 11,060, about -1,629 ticks below the market.

For now, we are out of the market waiting for the market to hit the down Fibonacci extension.

Then, we will look for the bullish reversal towards the monthly Fibonacci extension of 76,555.

The Bottom Line

While waiting for this BTC move to resolve itself, I have been working on a special strategy for identifying great stocks that you might want to learn more about.

If you’re interested, check out the important P.S. below…

For more on the markets as well as trading education and trading ideas like this one, look for the next edition of Josh’s Daily Direction in your email inbox each and every trading day.

I’ll be bringing you more of my stock and futures contract trading tutorials as well as some additional trading ideas.

And before you go, head on over to the Traders Agency YouTube channel for breaking market news, live trading sessions, educational videos and much, much more!

Keep on trading,

P.S. I have been working with my team to find what I call “marked stocks.”

These are stocks that are potentially setting up to generate big gains… And you need to get in on them with me.

The post Why the BTC Selling is Not Over Yet appeared first on Josh Daily Direction.