Good morning, Traders!

Last time, we discussed how waiting for the markets to get into a good buying position is one of the most important things we can do. Today, I’m happy to show you why that’s true! The Nasdaq 100 E-mini (NQ) is now in the buy zone and ready for us to prepare our entry strategy.

The NQ held at support within the daily timeframe and is breaking bullish through our counter trendline. That means the market is pushing into the buy zone and is heading to a higher price within the up trend at 16072.25.

And the one-hour timeframe reveals that the NQ has already broken the counter trendline and is headed for the high limit of 15383.0.

This is an example of how counter trendline breaks signal us to get ready to execute our buy-in strategy and prepare to make money in the NQ!

Let’s jump into our full timeframe analysis to see where the NQ is headed and how we can leverage this opportunity for profit:

Daily Timeframe Analysis

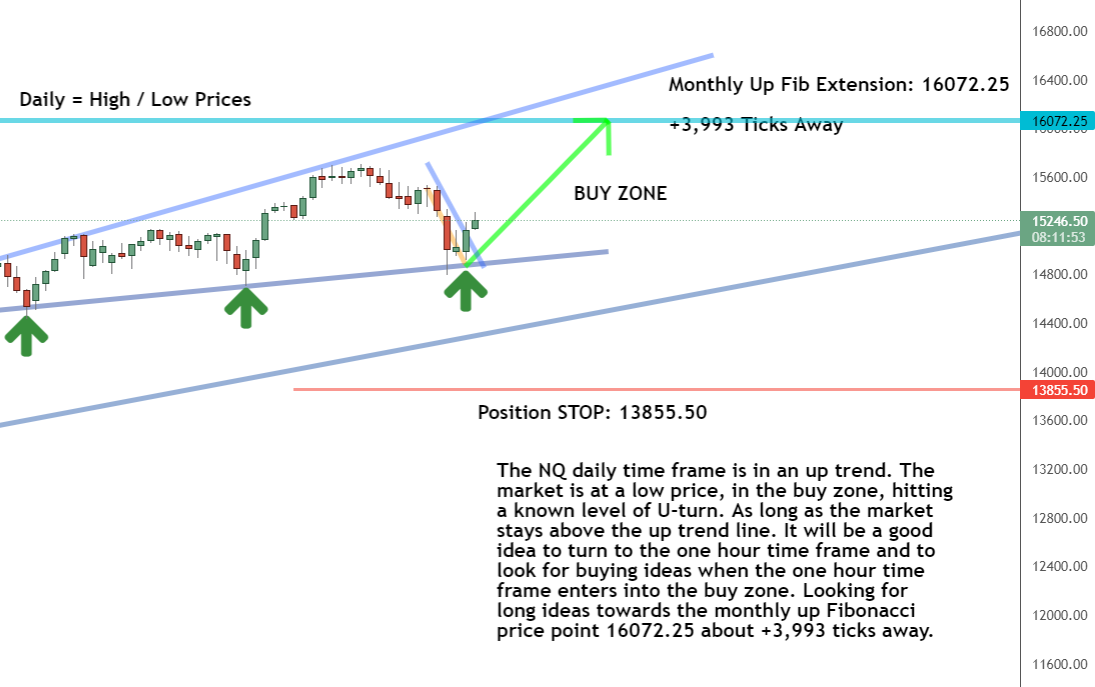

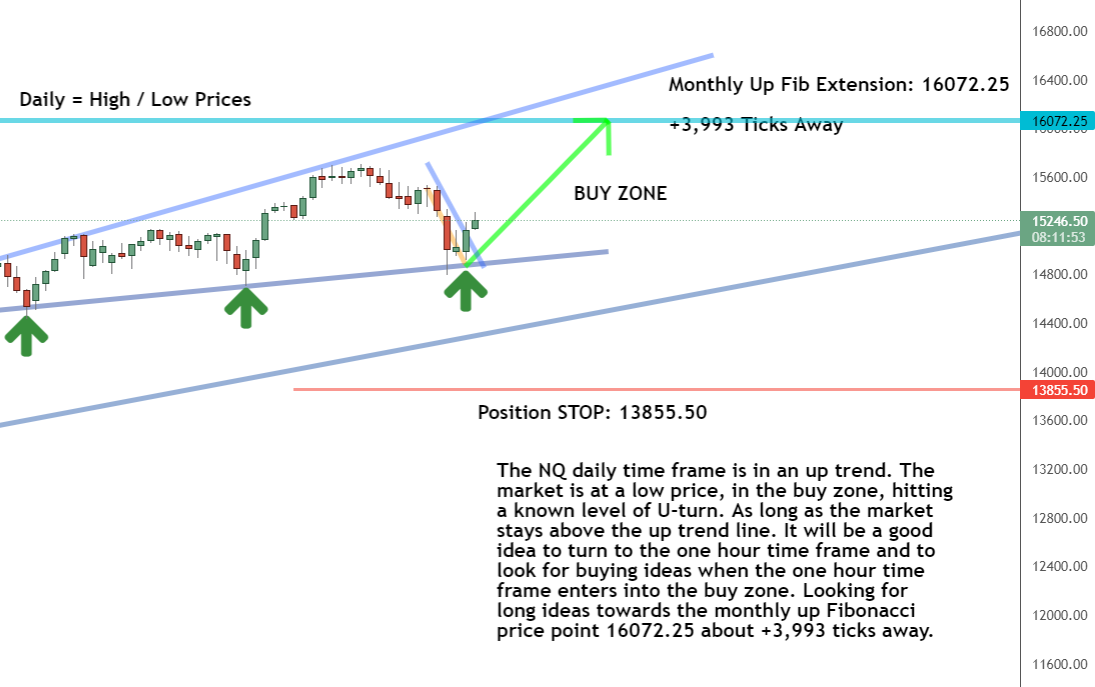

As you can see in the daily timeframe chart below, the NQ is breaking the counter trendline (the short diagonal line in the middle) and entering the buy zone. The market held at support and didn’t break through, so that’s a good sign that the NQ is pushing bullish and headed for higher prices.

The long-term direction is up for the NQ

The short-term direction of the NQ is now up

The NQ has pushed bullish and is now in the buy zone

Learn more about the Daily Direction Indicators here…

The NQ is breaking the counter trendline in the daily timeframe and headed for the next up Fibonacci of 16072.25

Remember that we use the daily timeframe to find our high/low prices before turning to the one-hour timeframe to look for opportunities to buy. Once we know that the NQ’s daily timeframe is showing us the price data we need, we can look at the hourly timeframe and see how we can buy the NQ for maximum profit!

One-Hour Timeframe Analysis

Right now, we’ll watch the NQ as it pushes toward the high limit of 15383.0. Now’s the time to look for buying opportunities as the bullish push continues in the NQ. You can see the steadily upward movement of the NQ, giving us low prices to buy as the market follows a generally positive trend.

The NQ has already broken our counter trendline in the one-hour timeframe and is pushing bullish toward the 15838 price point

It’s important that we remember how to utilize these market trading patterns to our advantage. The market will give us highs and lows within an upward trend. That’s how we decided when and how to use our entry strategy to buy the market and increase our chances of making money with futures!

The Bottom Line

The Nasdaq 100 E-mini is now in the buy zone. We can take the time to analyze our timeframe charts and look for opportunities to buy the market at low prices as it heads to higher prices overall.

Our daily timeframe will gives us our high and low prices, while the one-hour timeframe will show us when to enter the market as it continues to push bullish through the buy zone.

The Nasdaq 100 E-mini is now in the buy zone. We’re ready to use our entry strategy to buy the market and start making money!

And while I’m happy to share all of this vital information with you, it won’t do you any good if you aren’t using my strategy! Now’s the time to get on board. If you hesitate, you’ll keep missing these opportunities to increase your chances of making money in futures. There’s really no excuse for missing this. The market waits for no one!

Keep On Trading,

Mindset Advantage: Catch Your Breath!

If you’re not breathing, you’re not focused. If you’re not focused, you can’t see the market. Opportunities slide by in an instant. Hazards reveal themselves only when it’s too late.

You need to breathe. Breathing exercises have proven to reduce stress and increase focus.

Sure, you’re already breathing if you read this. But when you trade… you need a breathing regimen. Whatever it is: Through your nose, out your mouth counting to 10 or 100. Find a method and routine that works for you.

You’ll find balance, clarity and focus when you trade. Your heart rate will come down and you’ll just feel better.

Traders Training Session

Trading Longer Time Frames vs Shorter Time Frames

Stay tuned for my next edition of Josh’s Daily Direction.

And if you know someone who’d love to make this a part of their morning routine, send them over to https://joshsdailydirection.

The post You can’t afford to miss this trade appeared first on Josh Daily Direction.