Hey friend,

Time to see how the markets have been moving.

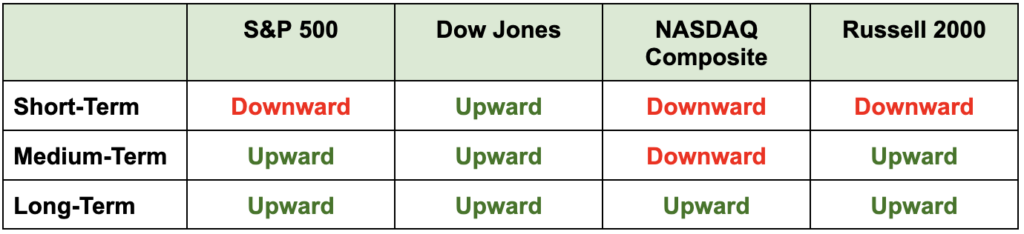

The Daily Direction

Note: Markets continued to pull back, with the Nasdaq’s medium-term direction now also flipping negative. That said, the index is still standing at the same level as it did one month ago.

The Daily Nugget

Use position sizing to manage risk during times of heightened uncertainty.

Too often, traders trap themselves with binary thinking – should I take the trade or not?

The setup may be a solid one that’s worked dozens of times in the past – but when the environment is uncertain, many are naturally hesitant to pull the trigger.

The solution lies in position sizing.

If you know the trade is a high-probability one, you can still take it and manage your risk via more conservative position sizing.

That’s an almost-too-simple strategy to help mitigate uncertainty – but one many traders forget.

With markets currently uncertain about what’s coming next, conservative position sizing can help you still obtain strong upside exposure while limiting your downside.

Speaking of upside exposure, Ross Givens is going LIVE right now to show you all the opportunities he’s still seeing in the middle of this pullback.

So click here to join him in the live room now…

And stop worrying so much about all the uncertainty.

The Traders Agency Team